hotel tax calculator quebec

Avalara automates lodging sales and use tax compliance for your hospitality business. If you are paying on meals the total tax would be 14975.

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for.

. About the 2022 Quebec Salary Calculator. In general the municipal. You can find these on the Taxi Fare Quebec details.

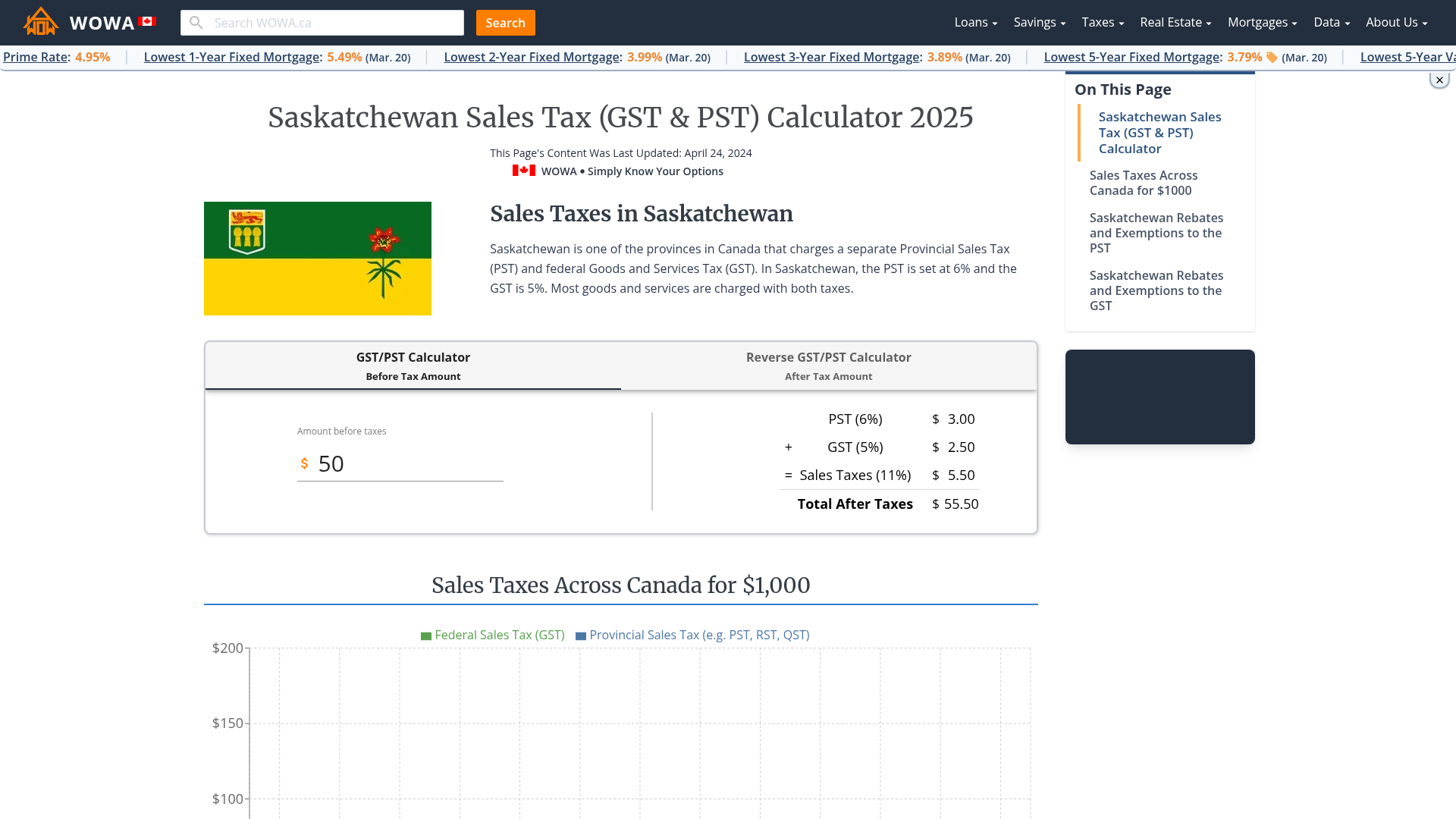

Formula for calculating the GST and QST. Amount without sales tax x QST rate100 QST amount. The basic fee is 455 the kilometer price is 175.

So it would be 100 - 10350 then 518 GST and 1032 in QST for a total of 11900. The accommodation unit is rented to an intermediary. Calculating the tax on lodging.

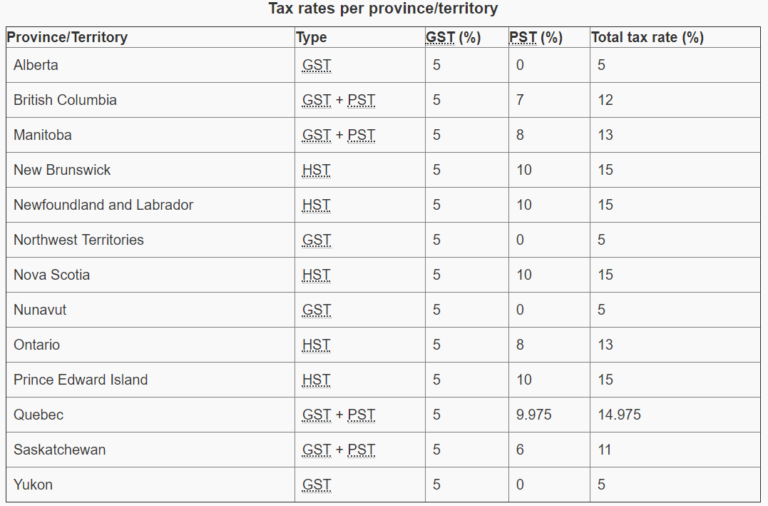

Nunavut territory GST 5. The tax on lodging is calculated only on the price of the overnight stay. Basically 18999125 on hotel rooms.

The rate you will charge depends on different factors see. No additional hotel room taxes in Nunavut. Le TIP est au moins égal à.

A quick and efficient way to compare. The following table provides the GST and HST provincial rates since July 1 2010. Calculate your take home pay in 2022 thats your 2022 salary after tax with the Canada Salary Calculator.

However it is 350 per overnight stay if. For standing and waiting time 3900 is charged per hour. Amount without sales tax.

The tax on lodging is usually 35 of the price of an overnight stay. Ad Finding hotel tax by state then manually filing is time consuming. So it would be 100 - 10350 then 518 GST and 1032 in QST for a total of 11900.

GSTHST provincial rates table. Tax billed by the operator of an establishment 35 tax on lodging billed on the price of an overnight stay. Amount before sales tax x GST rate100 GST amount.

Basically 18999125 on hotel rooms. This is any monetary amount. Commonly known as the Welcome Tax the Government of Québecs Land Transfer Tax system came to effect in 1992.

The breakdown of the municipal tax rate will differ across boroughs within municipalities. Avalara automates lodging sales and use tax compliance for your hospitality business. Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes.

I just got back from Quebec and was trying to figure out how to get the tax back on my hotel but Im looking at the itemized bills and I dont see the GSTHST listed. 2 tax on hotels with more than 20 rooms in Halifax and area. In November or December the Quebec City municipal council must announce the budget for the following year.

You will need to pay tax after buying a home in Quebec. No hotel tax or levy YUKON No hotel tax or levy BEYOND CANADA NEW YORK STATE New York State legislation plus munic-ipal andor county authorizations to collect taxes on their behalf. The period of reference or the tax year.

Attention certains barsrestaurants font payer le pourboire sur le montant TTC alors quil devrait être calculé sur le montant HT. The rate you will charge depends on different factors see. Calcul taxes TPS et TVQ au Québec.

Calculate the total income taxes of a Quebec residents for 2022 The calculator include the net tax income after tax tax return and the percentage of tax. A hotel tax of 3 as well as gst goods and services tax of 5 and tvq quebec sales tax of 75 are added to. This is income tax calculator for Québec province residents for year 2012-2021Quebec personal income tax rates are listed below and check this page for federal tax rates.

If you are paying on meals the total tax would be 14975. Montant avanthors taxes TPS 5 TVQ 9975 Montant avec taxes La nouvelle formule du calcul de la TPS et TVQ depuis 2013 Montant avant taxes x Taux de TPS100 Montant TPS. Ad Finding hotel tax by state then manually filing is time consuming.

In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at. Income Tax Calculator Quebec 2021. An education tax set by the province that is the same throughout Quebec.

The Quebec Income Tax Salary Calculator is updated 202223 tax year. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. The 2021 budget was announced last year and included a.

Simpletax Help How Do I Claim Travel Expenses Meals And Mileage Calculator

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Saskatchewan Sales Tax Gst Pst Calculator 2022 Wowa Ca

How To Calculate Sales Tax In Excel

Quebec Property Owners Rl 31 Slips And The Solidarity Tax Credit

How To Calculate Canadian Sales Tax Gst Hst Pst Qst Impac Solutions

Statistics Canada Property Taxes

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Commercial Real Estate Gst Hst And Qst Audit Issues

Alberta Gst Calculator Gstcalculator Ca

How To Calculate Sales Tax In Excel

Moving Expenses And Tax Deduction Move It

Statistics Canada Property Taxes

Statistics Canada Property Taxes